PRESS RELEASE

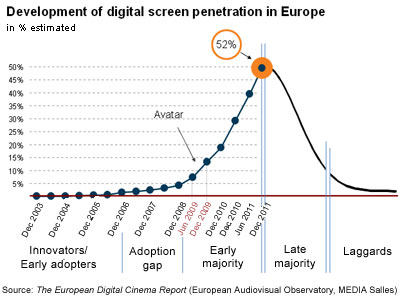

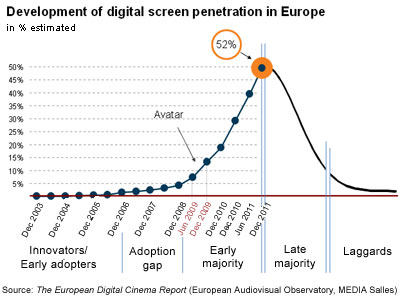

Over half of Europe’s screens

are now digital

but single-screen cinemas are struggling

A new report

from the European Audiovisual Observatory and MEDIA Salles shows

that around 18 500 digital screens had been installed in Europe

by the end of 2011. This means that over 52% of European screens

are now capable of digital projection, up from just 4% three years

ago (see graph).

While

the initial phase of large-scale digital conversion during 2009

and 2010 had been more or less entirely driven by 3D installations,

roll-out in 2011 was – for the first time – driven by 2D screens.

This suggests that roll-out has entered its second major phase and

is now driven primarily by full conversions of larger circuits under

VPF* schemes and by public initiatives ranging from legislation

(France), publicly funded industry-wide conversion schemes (Norway

and the Netherlands) to direct public funding schemes, 60 of which

have been identified at national, sub-national and pan-European

level, including the new MEDIA 2007 scheme. While

the initial phase of large-scale digital conversion during 2009

and 2010 had been more or less entirely driven by 3D installations,

roll-out in 2011 was – for the first time – driven by 2D screens.

This suggests that roll-out has entered its second major phase and

is now driven primarily by full conversions of larger circuits under

VPF* schemes and by public initiatives ranging from legislation

(France), publicly funded industry-wide conversion schemes (Norway

and the Netherlands) to direct public funding schemes, 60 of which

have been identified at national, sub-national and pan-European

level, including the new MEDIA 2007 scheme.

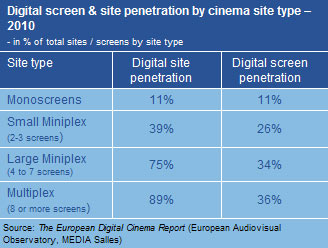

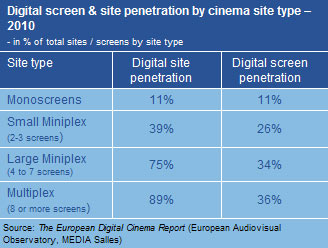

Analysis based

on a comprehensive site-by-site listing of analogue and digital

cinemas as of 2010 clearly shows that small cinemas and exhibitors

have significant problems converting to digital. By the end of 2010

only 11% of single-screen cinemas had installed a digital screen,

compared to 89% of multiplexes (see table). These small cinemas,

however, form a characteristic part of the European cinema landscape,

with single-screen cinemas alone accounting for almost 60% of all

European cinemas. Though presumably not vital for overall box office

results, these smaller cinemas play an important social and cultural

role in many communities. The fact that these screens have not yet

converted highlights tends to confirm that  commercial

financing models cannot cover all European cinemas, causing a funding

gap for between 15% and 20% of European screens. commercial

financing models cannot cover all European cinemas, causing a funding

gap for between 15% and 20% of European screens.

At the same time,

given the high penetration rates in various European markets, the

end of 35mm distribution seems to be approaching rapidly. Distributors

in Belgium, Luxembourg and Norway, which was the first country worldwide

to become fully digital in mid-2011, were expected to end 35mm distribution

as early as 2011/2012 and a total of 11 territories had converted

at least 50% of their screens by mid-2011, including the two leading

markets France and the UK.

Once large distributors switch to digital distribution in such major

markets, demand for film stock will drop significantly, putting

pressure on 35mm economics on a pan-European level. This could cause

financial strain for those distributors and exhibitors still depending

on it. Many of these are presumably small companies now faced with

a growing competitive disadvantage: digital cinema increases the

economies of scale related to both film exhibition as well as distribution

so bigger companies stand to benefit more than smaller players from

the transition to digital, both in terms of cost savings as well

as in increased revenue potential. This economic reality will ultimately

lead to fundamental change in the fragmented European theatrical

landscape and poses a challenge to the European independent sector,

characterised as it is by a large number of small exhibitors and

distributors.

The

‘European Digital Cinema Report’ (130 pages) is published

jointly by the European Audiovisual Observatory and MEDIA Salles

and provides the latest figures on digital screens and penetration

rates across 35 European markets, analyses the development of digital

roll-out and provides in-depth structural analysis with regard to

concentration levels by exhibitors and cinemas of different sizes.

It also features a list of the top 50 digital exhibitors in Europe

as well as estimated market shares for 3D technology, projector

and server manufacturers on a country-by-country basis. A special

chapter deals with the specific challenges faced by the European

independent sector. The report lists 60 dedicated public funding

schemes supporting the digitisation process at national, sub-national

and pan-European level, including the new MEDIA 2007 scheme. It

also provides a comprehensive set of key indicators for each of

the 35 European markets covered in the report. The

‘European Digital Cinema Report’ (130 pages) is published

jointly by the European Audiovisual Observatory and MEDIA Salles

and provides the latest figures on digital screens and penetration

rates across 35 European markets, analyses the development of digital

roll-out and provides in-depth structural analysis with regard to

concentration levels by exhibitors and cinemas of different sizes.

It also features a list of the top 50 digital exhibitors in Europe

as well as estimated market shares for 3D technology, projector

and server manufacturers on a country-by-country basis. A special

chapter deals with the specific challenges faced by the European

independent sector. The report lists 60 dedicated public funding

schemes supporting the digitisation process at national, sub-national

and pan-European level, including the new MEDIA 2007 scheme. It

also provides a comprehensive set of key indicators for each of

the 35 European markets covered in the report.

For further information see http://www.obs.coe.int/oea_publ/european_digital_cinema.html.

* The Virtual Print Fee (VPF) is a financing mechanism for funding

the first purchase of digital cinema equipment. It is based on distributors

and alternative content suppliers paying a fee every time a digital

copy of their content is booked.

|

![]()

![]()

While

the initial phase of large-scale digital conversion during 2009

and 2010 had been more or less entirely driven by 3D installations,

roll-out in 2011 was – for the first time – driven by 2D screens.

This suggests that roll-out has entered its second major phase and

is now driven primarily by full conversions of larger circuits under

VPF* schemes and by public initiatives ranging from legislation

(France), publicly funded industry-wide conversion schemes (Norway

and the Netherlands) to direct public funding schemes, 60 of which

have been identified at national, sub-national and pan-European

level, including the new MEDIA 2007 scheme.

While

the initial phase of large-scale digital conversion during 2009

and 2010 had been more or less entirely driven by 3D installations,

roll-out in 2011 was – for the first time – driven by 2D screens.

This suggests that roll-out has entered its second major phase and

is now driven primarily by full conversions of larger circuits under

VPF* schemes and by public initiatives ranging from legislation

(France), publicly funded industry-wide conversion schemes (Norway

and the Netherlands) to direct public funding schemes, 60 of which

have been identified at national, sub-national and pan-European

level, including the new MEDIA 2007 scheme.  commercial

financing models cannot cover all European cinemas, causing a funding

gap for between 15% and 20% of European screens.

commercial

financing models cannot cover all European cinemas, causing a funding

gap for between 15% and 20% of European screens.  The

‘European Digital Cinema Report’ (130 pages) is published

jointly by the European Audiovisual Observatory and MEDIA Salles

and provides the latest figures on digital screens and penetration

rates across 35 European markets, analyses the development of digital

roll-out and provides in-depth structural analysis with regard to

concentration levels by exhibitors and cinemas of different sizes.

It also features a list of the top 50 digital exhibitors in Europe

as well as estimated market shares for 3D technology, projector

and server manufacturers on a country-by-country basis. A special

chapter deals with the specific challenges faced by the European

independent sector. The report lists 60 dedicated public funding

schemes supporting the digitisation process at national, sub-national

and pan-European level, including the new MEDIA 2007 scheme. It

also provides a comprehensive set of key indicators for each of

the 35 European markets covered in the report.

The

‘European Digital Cinema Report’ (130 pages) is published

jointly by the European Audiovisual Observatory and MEDIA Salles

and provides the latest figures on digital screens and penetration

rates across 35 European markets, analyses the development of digital

roll-out and provides in-depth structural analysis with regard to

concentration levels by exhibitors and cinemas of different sizes.

It also features a list of the top 50 digital exhibitors in Europe

as well as estimated market shares for 3D technology, projector

and server manufacturers on a country-by-country basis. A special

chapter deals with the specific challenges faced by the European

independent sector. The report lists 60 dedicated public funding

schemes supporting the digitisation process at national, sub-national

and pan-European level, including the new MEDIA 2007 scheme. It

also provides a comprehensive set of key indicators for each of

the 35 European markets covered in the report.